BTC Price Prediction: Navigating the $95K Support Battle

#BTC

BTC Price Prediction

BTC Technical Analysis: Key Levels to Watch

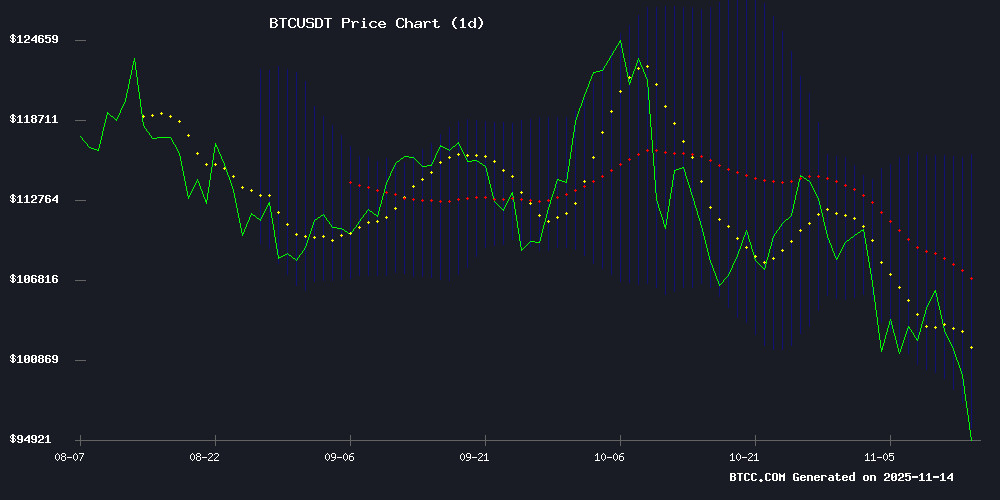

BTC is currently trading at $94,863, below its 20-day moving average of $105,956, indicating potential short-term bearish pressure. The MACD shows a bullish crossover with the histogram at 1,472, suggesting some upward momentum. Bollinger Bands reveal price hovering NEAR the lower band at $95,768, which could act as support. Analyst Sophia from BTCC notes that holding above $95K is critical to avoid a deeper correction towards $80K.

Market Sentiment: Bitcoin Faces Headwinds Amid Correction Fears

Recent headlines highlight mixed sentiment around Bitcoin. While institutional interest grows (e.g., Luxembourg’s sovereign wealth fund allocation and CleanSpark’s $1.15B raise), fears of a prolonged correction persist. Michael Saylor’s ‘HODL’ call and Eric Trump’s gold-to-BTC shift prediction contrast with Rekt Capital’s warning about key support levels. BTCC’s Sophia observes that despite panic, fundamentals like MicroStrategy’s custody restructuring and ABC’s mining growth suggest long-term bullish undercurrents.

Factors Influencing BTC’s Price

Bitcoin Struggles Below $100K as Market Sentiment Sours

Bitcoin's price action weakens as it enters the weekend trading below the critical $100,000 level. Currently hovering around $95,900, BTC has posted losses across all short-term timeframes: -3.5% (24h), -5.5% (7d). Market capitalization stands at $1.93 trillion with $127 billion in 24-hour volume.

Fear dominates sentiment as the Fear & Greed Index plunges to 22. Traders weigh macro uncertainty, ETF outflows, and thinning exchange liquidity against the possibility of a routine market shakeout. The broader crypto market reflects this tension, with total capitalization slipping to $3.28 trillion.

Technical analysts flag concerning patterns, with some identifying Wyckoff Distribution formations that often precede major cycle tops. The $100,000 level now serves as a key resistance point—its reclaim or rejection will likely determine near-term momentum.

Bitcoin Tests $95K Support Amid Fears of Deeper Correction to $80K

Bitcoin's sharp retreat from its October peak of $126,000 has traders bracing for a potential test of the $80,000 level. The cryptocurrency now hovers at $95,524, marking a 14% monthly decline as spot ETF outflows and heavy profit-taking dominate market sentiment.

Nearly $900 million fled Bitcoin ETFs in 24 hours, with Grayscale's trust alone shedding $318 million. Yet trading volumes surged 69% to $129 billion - a telltale sign of distribution. The market stands at a crossroads: either the $95,000 support holds firm, or the path clears for a 20% plunge toward $80,000.

Diverging views emerge among analysts. Some point to dormant wallets reactivating as evidence of strategic accumulation, while others warn the selling cascade may just be beginning. The coming days will reveal whether this is a healthy correction or the start of something more severe.

CleanSpark Secures $1.15 Billion in Convertible Notes to Fuel Expansion

CleanSpark, a prominent Bitcoin mining company, has successfully raised $1.15 billion through a private offering of zero-coupon convertible senior notes due in 2032. Institutional buyers participated in the offering, with net proceeds totaling $1.13 billion after expenses.

The firm simultaneously repurchased 30.6 million shares of its common stock, representing 10.9% of outstanding shares, at a cost of approximately $460 million. This strategic move aims to optimize capital structure while funding ambitious growth plans.

Proceeds will be allocated toward power and land acquisitions, data-center development, and repayment of Bitcoin-backed credit lines. The company's expansion strategy includes developing AI-driven data center infrastructure on a newly acquired 271-acre site in Austin County, Texas.

Market reaction was immediate, with CleanSpark's stock closing 10.13% lower on the offering day, reflecting broader sector volatility. Chairman and CEO Matt Schultz emphasized the transaction's significance in positioning the company for long-term growth in the evolving digital asset infrastructure landscape.

Luxembourg Allocates Sovereign Wealth Fund to Bitcoin in Strategic Crypto Move

Luxembourg has made a decisive entry into cryptocurrency markets by allocating 1% of its Intergenerational Sovereign Wealth Fund (FSIL) to Bitcoin. The €7 million investment signals a long-term commitment to the flagship cryptocurrency, as articulated by Finance Minister Gilles Roth at Bitcoin Amsterdam 2025. "We're in it for the long haul," Roth declared, positioning Luxembourg as a pioneer among sovereign wealth funds.

The nation deliberately excluded altcoins from its strategy, with Roth stating "There is no second best" when explaining the Bitcoin-only approach. This move reinforces Luxembourg's dual role as both a crypto investment leader and a European hub for fintech regulation. The FSIL's investment framework technically permits broader crypto diversification, but policymakers have chosen concentrated exposure to Bitcoin's store-of-value proposition.

Michael Saylor Urges Bitcoin Holders to 'HODL' Amid Market Downturn

MicroStrategy Executive Chairman Michael Saylor delivered a succinct but potent message to Bitcoin investors as prices tumbled toward $94,000. His tweet featured an image evoking the Titanic's evacuation with the caption "HODL"—crypto parlance for holding assets during volatility.

The symbolic post coincided with a broader crypto market retreat, underscoring the psychological battleground of digital asset investing. Saylor's lifeboat metaphor reinforces his longstanding advocacy for Bitcoin as a generational store of value, even as traders grapple with short-term price dislocations.

Eric Trump Predicts Major Shift from Gold to Bitcoin

Eric Trump, Chief Strategy Officer at American Bitcoin, anticipates a significant reallocation of investment capital from gold to Bitcoin. Speaking at Yahoo Finance's Invest event, he emphasized that the trend will accelerate as digital assets gain broader institutional and retail acceptance.

The shift reflects growing confidence in Bitcoin's store-of-value proposition, with Trump noting the rotation could become "disproportionate" in Bitcoin's favor. The comments underscore the evolving narrative of cryptocurrencies challenging traditional safe-haven assets.

Bitcoin Must Hold Key Levels to Maintain Bullish Structure, Says Rekt Capital

Bitcoin's short-term downward pressure has drawn attention to critical support levels that could determine its long-term trajectory. Technical analyst Rekt Capital emphasizes the importance of these thresholds in preserving BTC's bullish structure.

Market observers are scrutinizing Bitcoin's price action after recent declines. The cryptocurrency's ability to sustain momentum hinges on maintaining specific technical levels, according to the analysis.

MicroStrategy's $5.7B Bitcoin Custody Restructure Sparks Market Confusion

MicroStrategy, the business intelligence firm turned Bitcoin behemoth, executed a $5.7 billion BTC transfer between wallets, triggering unwarranted sell-off fears. CEO Michael Saylor swiftly clarified the movement as part of an operational custody upgrade, not a liquidation. The company's 641,692 BTC stash remains intact—a $62 billion vote of confidence in the asset.

Market observers misread blockchain analytics as a potential divestment, highlighting the sensitivity of crypto markets to institutional moves. Such transfers now carry outsized weight amid tightening U.S. monetary policy and spot ETF flows. MicroStrategy's unwavering HODL stance contrasts sharply with traders' knee-jerk reactions to on-chain activity.

MicroStrategy CEO Denies Bitcoin Sell-Off Rumors Amid Market Panic

MicroStrategy CEO Michael Saylor swiftly countered market speculation that the company was offloading portions of its Bitcoin holdings. The rumors gained traction after traders misinterpreted wallet movements as sell signals. Saylor clarified on CNBC that MicroStrategy continues to accumulate Bitcoin, with plans to disclose its latest purchases early next week.

The company's unwavering commitment to its Bitcoin strategy comes at a critical juncture. Bitcoin prices slid toward $96,000, while MicroStrategy's stock fell 4% in early trading, extending its year-to-date decline to nearly 35%. Saylor later reinforced his position on social media, stating unequivocally that the sell-off rumors were false.

Market anxiety appears to have amplified the misinformation. Analysts note that MicroStrategy's accelerated accumulation strategy may have contributed to the wallet activity that sparked confusion. The episode underscores the volatility and sentiment-driven nature of cryptocurrency markets, where on-chain data can be easily misread during periods of price weakness.

American Bitcoin Corp. Doubles Revenue and Mining Power in Q3 2025 Surge

American Bitcoin Corp. (ABTC) has reported a dramatic turnaround in its Q3 2025 financial results, with revenue soaring to $64.2 million—a stark reversal from the $11.6 million recorded in the same period last year. Net income reached $3.5 million, erasing prior losses, while adjusted EBITDA climbed to $27.7 million, underscoring operational efficiency.

The company's dual mining and purchasing strategy has fueled a 56% gross margin, up from 49% last quarter, reflecting disciplined cost control. Mining capacity expanded to 25 EH/s, cementing ABTC's position as a top U.S. miner. Its merger with Gryphon Digital Mining, now trading under Nasdaq ticker "ABTC," signals further scalability.

Despite a 1.56% dip in stock price to $4.6662, the results highlight ABTC's robust execution in an increasingly competitive Bitcoin mining landscape.

Bitcoin Not in Bear Market Despite Correction, Says CryptoQuant CEO

CryptoQuant CEO Ki Young Ju asserts Bitcoin remains outside bear market territory, citing sustained capital inflows as the key metric. The cryptocurrency's realized capitalization has surged to a record $1.1 trillion, according to on-chain data shared by the executive.

Market participants view realized cap—calculated by valuing each coin at its last transaction price—as a more stable indicator than market capitalization. The milestone suggests substantial new money entering the Bitcoin ecosystem despite recent price volatility.

Is BTC a good investment?

BTC presents a high-risk, high-reward opportunity at current levels. Below is a snapshot of critical metrics:

| Indicator | Value | Implication |

|---|---|---|

| Price | $94,863 | Testing support |

| 20-day MA | $105,956 | Resistance zone |

| MACD Histogram | +1,472 | Bullish momentum |

| Bollinger Lower Band | $95,768 | Key support |

Sophia advises that investors with a 12+ month horizon could accumulate, but short-term traders should wait for confirmation above $100K.

- Technical Outlook: BTC must defend $95K to prevent a drop to $80K; MACD hints at potential rebound.

- Market Sentiment: Institutional inflows clash with retail fear, creating volatility.

- Long-Term Thesis: Sovereign adoption and mining expansion support bullish fundamentals.